are charitable raffle tickets tax deductible

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20.

The irs has adopted the position that the 100 ticket.

. The purchase of a raffle ticket is not considered a charitable donation. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a. However the answer to why raffle tickets are not tax-deductible is quite simple.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. If the organization fails to. The IRS has determined that purchasing the chance to win a prize has value that is.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. How much of a tax break do you get for donating to charity. The IRS has determined that purchasing the chance to win a prize has value that is essentially.

Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by. An organization that pays raffle prizes must withhold 25 from the winnings and report this. The cost of a raffle ticket is not.

What about raffle tickets. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Porte Brown answers the most common questions regarding charitable contributions. Are fundraisers tax deductible.

This is because the purchase of raffle. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. The IRS considers a raffle ticket to be a contribution.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you.

This might sound nonsensical on the. The IRS has determined that purchasing the chance to win a prize has value that is. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

A gala dinner costs 100 per. What charity is tax deductible. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

To claim a deduction you must have a written record of your donation. All entrants must be 18 years of. Are raffle tickets for a nonprofit tax-deductible.

So can i deduct the money for the tickets as a. What you cant claim You cant claim gifts or donations that provide you with a personal benefit such as. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Autograph Football Derek Carr 4 Raffle Ticket 5 00 Overflow Sports Academy

Fundraising Events And Cause Related Marketing Pdf Free Download

50 50 Raffle A Chance To Grow Brain Centered Therapy Services

Free 26 Sample Raffle Tickets In Psd Ai Ms Word

Muscle Car Raffle For Charity Barky Pines Animal Rescue Sanctuary

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Winning Scc 50 50 Raffle Ticket News Media Las Vegas Motor Speedway

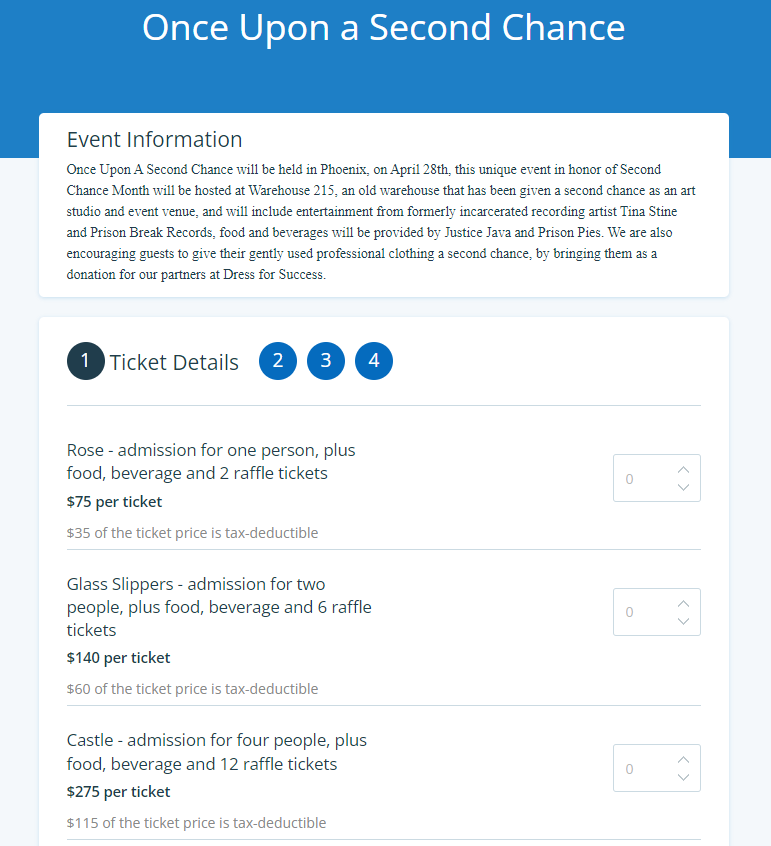

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Professional Musky Tournament Trail Pmtt Post Facebook

10 Inspiring Examples Of Nonprofit Ticket Sale Campaigns

Deductions For Donations Your Guide To Tracking Charitable Contributions Quicken Loans

Charitable Contributions You Think You Can Claim But Can T Turbotax Tax Tips Videos

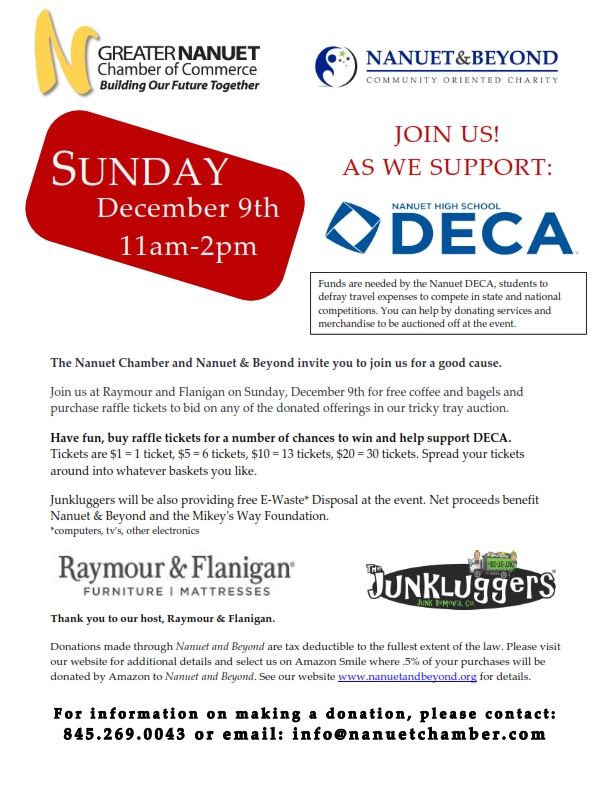

2018 Tricky Tray To Benefit Deca Nanuet Chamber Of Commerce

Luck Of The Griffin Mega Raffle Fr Mcgivney Catholic High School Glen Carbon Il

Gridiron Specialolympicslouisiana

Cares Act Changes Deducting Charitable Contributions Made In 2020 Karen Ann Quinlan Hospice